9-Month Key Sales Figures

Fiscal Year 2020/21

9-Month Key Sales Figures

Fiscal Year 2020/21

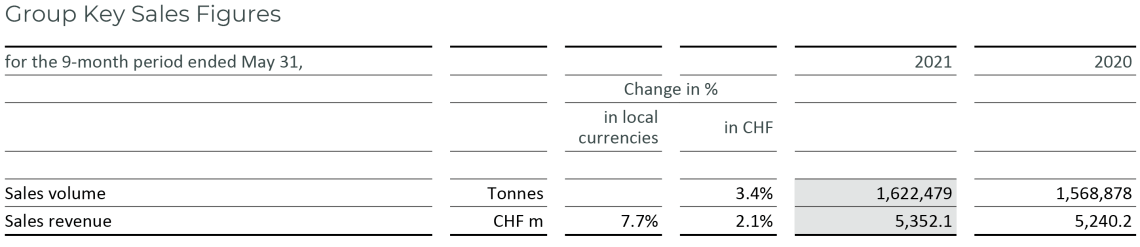

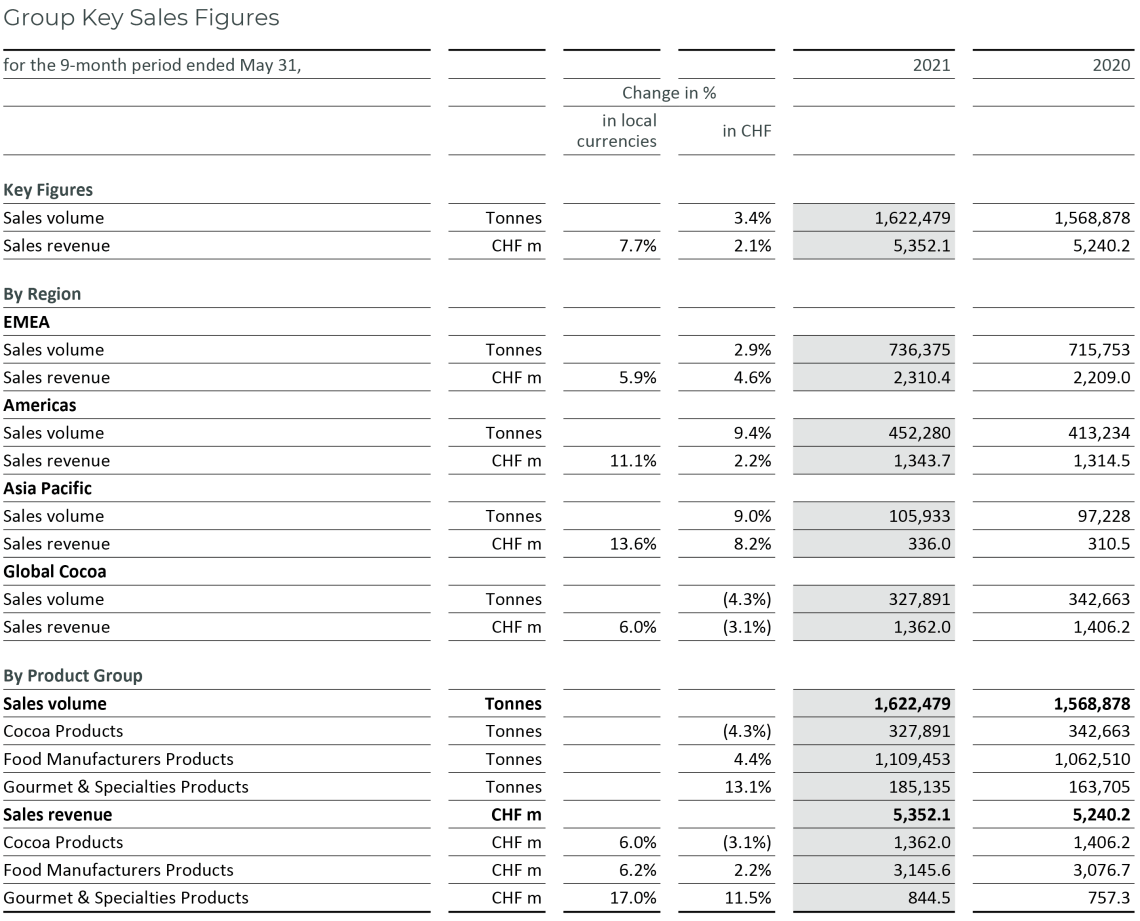

- Sales volume up +3.4% in the first nine months, strong chocolate performance in the third quarter (+21.2%)

- Sales revenue of CHF 5.4 billion, up +7.7% in local currencies (+2.1% in CHF)

- Confident on mid-term guidance1

In the third quarter we delivered accelerating volume growth against a weak comparison base. Thanks to this regained momentum and a strong chocolate performance, we are solidly back into positive territory for the first nine months of the fiscal year and surpassing pre-COVID-19 volume².

The Barry Callebaut Group, the world’s leading manufacturer of high-quality chocolate and cocoa products, reported an accelerating sales volume growth of +3.4% to 1,622,479 tonnes during the first nine months of fiscal year 2020/21 (ended May 31, 2021). In particular the chocolate business regained momentum in the third quarter (+21.2%), resulting in a good performance of +5.6% over the first nine months of fiscal year 2020/21, well ahead of the underlying global chocolate confectionery market (+1.2%3). The volume growth was supported by all Regions (Americas +9.4%, Asia Pacific +9.0%, EMEA +2.9%) and with positive contribution from the Group’s key growth drivers Gourmet & Specialties (+13.1%), Emerging Markets (+12.5%, excluding Cocoa) and Outsourcing (+5.5%). Sales volume in Global Cocoa also turned positive in the third quarter (+8.4%), reducing the volume decline after nine months to –4.3%.

Sales revenue amounted to CHF 5,352.1 million, up +7.7% in local currencies (+2.1% in CHF).

Outlook – Confident to deliver on mid-term guidance

Looking ahead, CEO Antoine de Saint-Affrique said:

As markets are gradually reopening, we expect further normalization of operations and growth to continue. A strong customer focus, a range of exciting innovations and a solid financial basis give us the confidence to deliver on our mid-term guidance.

1 On average for the 3-year period 2020/21 to 2022/23: 5-7% volume growth and EBIT above volume growth in local currencies, barring any major unforeseeable events and based on the assumption of a gradual recovery from COVID-19.

2 Compared to sales volume for the first nine months 2018/19: 1,589,181 tonnes.

3 Source: Nielsen volume growth excluding e-commerce – 25 countries, September 2020 to April/May 2021, data subject to adjustment to match Barry Callebaut’s reporting period. Nielsen data only partially reflects the out-of-home and impulse consumption.

Strategic milestones in the first nine months of fiscal year 2020/21

Expansion: In June 2021, Barry Callebaut signed an agreement to acquire Europe Chocolate Company (ECC), a privately-owned B2B manufacturer of chocolate specialties and decorations, located in Malle, Belgium. This strategic acquisition expands the Group's value adding specialties capabilities, allowing Barry Callebaut to cater to the increasing demand from Food Manufacturers for highly customized chocolate specialties and decorations with Belgian chocolate quality.

In early July 2021, Barry Callebaut announced the start of a long-term outsourcing agreement with Atlantic Stark, a large chocolate confectionery manufacturer in South Eastern Europe. Atlantic Stark is supplied from Barry Callebaut's new factory in Novi Sad, Serbia. Also in July 2021, Barry Callebaut announced the opening of its third production site in Russia, in the special economic zone of Kaliningrad. This factory will further strengthen Barry Callebaut’s presence in the world's third-largest chocolate confectionery market4.

In Region Americas, Barry Callebaut signed in June 2021 a new significant outsourcing agreement to supply a large confectionery manufacturer with chocolate, starting in September 2021.

Innovation: Barry Callebaut’s global Gourmet brand Cacao Barry launched WholeFruit Evocao™, a unique chocolate for chefs and artisans made from 100% pure cacaofruit. WholeFruit chocolate contains exclusively sugars obtained from cacao pulp and 40% less sugar than most dark chocolates. WholeFruit Evocao™ is available for professional artisans in France, the UK, Italy, Canada, the US, Brazil and Japan. As of 2022, distribution will be progressively extended to other countries, with additional exciting flavor profiles to follow.

In June 2021, the Group’s pioneer cocoa brand Van Houten launched a powdered chocolate drink made from ruby chocolate for HoReCa customers in selected European markets. Like all Van Houten products, ruby chocolate drink powder is made with 100% sustainably sourced cocoa beans.

Sustainability: Barry Callebaut kicked off in June 2021 its first ESG roadshow and webinar. The events brought both the Group CFO and the Chief Sustainability Officer together with investors and ESG rating agencies to discuss Barry Callebaut’s actions in managing the key Environmental, Social and Governance risks in its chocolate supply chain.

At the Sustainable Food Summit in June 2021, Barry Callebaut's innovative brand Cabosse Naturals won the sustainable ingredients category for upcycling the pulp and peel of the cacaofruit into a range of 100% pure cacaofruit ingredients.

Being carbon and forest positive is one of the key targets of Forever Chocolate, the Group’s plan to make sustainable chocolate the norm by 2025. In April 2021, Barry Callebaut, one of the leading signatories of the Cocoa & Forests Initiative (CFI), a multi stakeholder platform to end deforestation caused by cocoa production in Côte d’Ivoire and Ghana, published its second CFI Company Progress Report. The key achievements include the public disclosure of Barry Callebaut’s direct cocoa suppliers, continued progress on the location mapping of cocoa farms and the distribution of seedlings and shade trees.

Furthermore, in May 2021, Barry Callebaut released an industry-first High Carbon Stock (HCS) map that identifies forests with high conservation value and areas where deforestation would cause the highest carbon emissions. This highly automated and publicly available tool resulted from the company’s collaboration with Swiss Federal Institute of Technology (ETH) Zurich.

4 Source: Euromonitor, Chocolate confectionery markets 2020.

Regional/Segment performance

Region EMEA – Continued volume recovery

Sales volume in Region EMEA (Europe, Middle East and Africa) increased by +2.9% to 736,375 tonnes. Volume recovery accelerated in the third quarter against a low base and despite ongoing restrictions in major European markets. The underlying chocolate confectionery market grew +1.0%5. Food Manufacturers reported an accelerated volume recovery in the third quarter, achieving low single-digit volume growth in the first nine months of the fiscal year. The acceleration was supported by continued positive momentum in Eastern Europe, where outsourcing contracts signed during the COVID-19 pandemic are now ramping up. The newly signed outsourcing contract with Atlantic Stark underpins the strength of the pipeline. Despite the ongoing challenging environment, Gourmet & Specialties progressively recovered in the nine months under review, returning to positive high single-digit territory. Sales revenue in the Region amounted to CHF 2,310.4 million, up +5.9% in local currencies (+4.6% in CHF).

Region Americas – Accelerated volume momentum

In Region Americas momentum accelerated in the third quarter, leading to a volume increase of +9.4% to 452,280 tonnes for the first nine months of the fiscal year, well ahead of the regional chocolate confectionery market (+2.4%5). Food Manufacturers continued its growth trajectory, in particular with large corporate accounts in North America, showing double-digit volume growth. Barry Callebaut continues to expand and invest in the Region to serve customers’ needs and further exploit opportunities, exemplified by a recently signed significant outsourcing contract. Gourmet & Specialties volume growth accelerated strongly in the third quarter, bringing it back to the high-teens for the first nine months of fiscal year 2020/21. Sales revenues increased by +11.1% in local currencies (+2.2% in CHF) to CHF 1,343.7 million.

Region Asia Pacific – Healthy growth momentum continues

In Region Asia Pacific healthy growth continues with volume up +9.0% to 105,933 tonnes, significantly outpacing the regional chocolate confectionery market (–0.8%5). Food Manufacturers sustained its solid and broad based growth. Gourmet & Specialties volume accelerated in the third quarter across the Region, bringing growth back in the solid double-digit range for the period under review. Sales revenue amounted to CHF 336.0 million, up +13.6% in local currencies (+8.2% in CHF).

Global Cocoa – Volatile market environment

Against a low comparison base, Global Cocoa recorded positive sales growth in the third quarter, leading to a sales volume decline of –4.3% to 327,891 tonnes for the 9-month period under review. The market environment remains volatile with global cocoa supply and demand out of balance due to the COVID-19 pandemic, and, in particular, logistical challenges in the supply chain. Sales revenue amounted to CHF 1,362.0 million, up +6.0% in local currencies (–3.1% in CHF).

Price developments of key raw materials

During the first nine months of fiscal year 2020/21, terminal market6 prices for cocoa beans fluctuated between GBP 1,607 and GBP 1,869 per tonne and closed at GBP 1,632 per tonne on May 28, 2021. On average, cocoa bean prices decreased by –9.3% versus the prior-year period. The outlook for global bean supply and demand indicates a sizable surplus.

World sugar prices increased on average by +19.1% on the back of strong demand from China in combination with delayed exports from India and lower crop expectations in Brazil. Sugar prices in Europe remained on average stable (+0.2%) compared to the demand-related lower prices at the

beginning of the COVID-19 pandemic in the prior-year period.

Dairy prices continued to increase on the back of strong demand from Asia, weak European milk supply, and some supply chain constraints. However, on average prices in the period under review were still slightly lower compared to the same prior-year period (–1.0%).

5 Source: Nielsen. The volume growth for the period September 2020 to April/May 2021, 25 countries. Data is subject to adjustment to match Barry Callebaut’s reporting period. The underlying chocolate confectionery market growth according to Nielsen does not include e-commerce and only partially reflects the out-of-home and impulse consumption.

6 Source: London terminal market prices for 2nd position, September 2020 to May 2021. Terminal market prices exclude Living Income Differential (LID) and country differentials.

Financial Calendar for Fiscal Year 2020/21

(September 1, 2020 to August 31, 2021)

| Full-Year Results 2020/21 | November 10, 2021 |

| Annual General Meeting 2020/21 | December 8, 2021 |

Available downloads

Media assets

About Barry Callebaut Group:

With annual sales of about CHF 6.9 billion (EUR 6.4 billion / USD 7.1 billion) in fiscal year 2019/20, the Zurich- based Barry Callebaut Group is the world’s leading manufacturer of high-quality chocolate and cocoa products – from sourcing and processing cocoa beans to producing the finest chocolates, including chocolate fillings, decorations and compounds. The Group runs more than 60 production facilities worldwide and employs a diverse and dedicated global workforce of more than 12,000 people.

The Barry Callebaut Group serves the entire food industry, from industrial food manufacturers to artisanal and professional users of chocolate, such as chocolatiers, pastry chefs, bakers, hotels, restaurants or caterers. The global brands catering to the specific needs of these Gourmet customers are Callebaut® and Cacao Barry®, Carma® and the decorations specialist Mona Lisa®.

The Barry Callebaut Group is committed to make sustainable chocolate the norm by 2025 to help ensure future supplies of cocoa and improve farmer livelihoods. It supports the Cocoa Horizons Foundation in its goal to shape a sustainable cocoa and chocolate future.