Half-Year Results Fiscal Year 2023/24 of the Barry Callebaut Group

Half-Year Results Fiscal Year 2023/24 of the Barry Callebaut Group

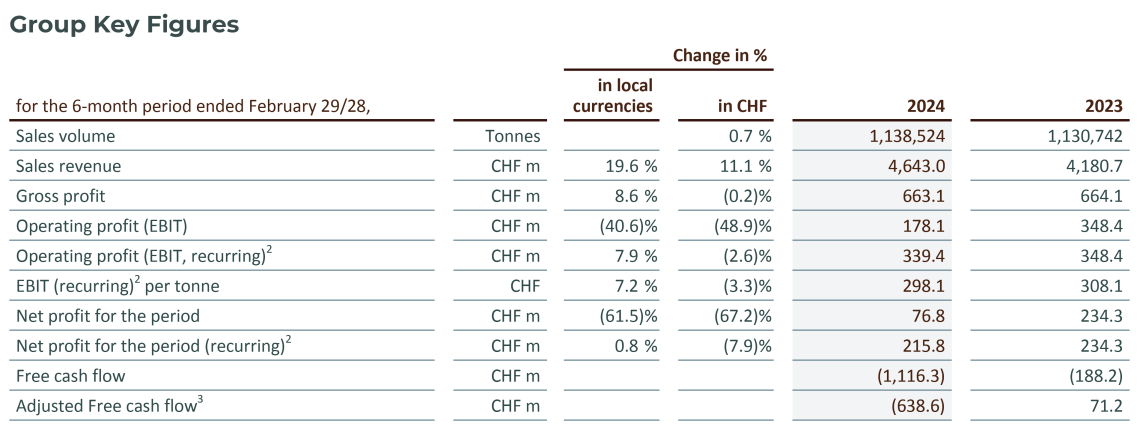

- +0.7% volume growth in Half-Year 2023/24, +1.0% in the second quarter in a challenging market

- Implementation of BC Next Level strategic investment program progressing as planned, dialogue with social partners ongoing

- Significant increase in cocoa prices driving a +19.6% sales revenue growth in local currencies (+11.1% in CHF) to CHF 4.6 billion in Half-Year 2023/24

- Profitability supported by cost-plus pricing model. Net profit recurring1 up +0.8% in local currencies (-7.9% in CHF). Operating profit (EBIT) recurring1 up +7.9% in local currencies (-2.6% in CHF)

- Due to one-off BC Next Level operating expenses (of which the majority are non-cash impairments and write-downs), operating profit (EBIT) reported down -40.6% in local currencies (-48.9% in CHF)

- Free cash flow of CHF -1,116.3 million due to the bean price impact on working capital, given the long cycle between bean contracting and customer sales

- Additional financing secured, including a CHF 600 million bond which helped to mitigate higher cash requirements in bean sourcing

- Reiterating Full-Year 2023/24 guidance of flat volume and flat EBIT on a recurring basis in constant currency, closely monitoring highly volatile environment

1 Please refer to appendix for the detailed recurring results reconciliation.

Peter Feld, CEO of the Barry Callebaut Group, commented:

In a very disruptive external environment, we delivered a solid financial performance. With our integrated and diversified business model as well as our strong balance sheet, we remain a reliable partner for our customers. We retain some caution given the extraordinary price spikes over the past six months and potential implications for our customers and supply partners.

Our strategic investment program BC Next Level is the cornerstone of Barry Callebaut’s future success and we are tracking to plan. We are making our business more resilient by bringing us even closer to our customers, streamlining operations and accelerating our digital transformation. Besides investments in areas that matter most to our customers, we are implementing efficiency measures to streamline our structures and avoid double-work. We are currently in discussions with our social partners for the implementation of key activities and we are fully committed to supporting all of our employees who may be affected by our plans.

2 Please refer to appendix on page 8 for the detailed recurring results reconciliation.

3 Adjusted Free cash flow is adjusted for the cash flow impact of cocoa bean inventories regarded by the Group as readily marketable inventories (RMI).

4Source: Nielsen volume growth excluding e-commerce – 26 countries, August 2023 - January 2024. Data subject to adjustment to match Barry Callebaut's reporting period. Nielsen data only partially reflects the out-of-home and impulse consumption.

The Barry Callebaut Group reported sales volume growth of +0.7% (to 1.1 million tonnes) in the first six months of fiscal year 2023/24 (ended February 29, 2024). Volume was resilient at +1.0% in the second quarter, in the context of a challenging operating environment.

Global Chocolate delivered +1.0% volume growth, ahead of a declining global chocolate confectionery market according to Nielsen4 (-2.0%). Food Manufacturers continued to be impacted by soft consumer demand in the context of the high-inflationary environment. Barry Callebaut was able to mitigate these pressures as its diversified business model allowed the Group to capture the consumer shift towards Private Label chocolate offerings. Gourmet & Specialties recorded high single-digit volume growth, with continued strong demand across regions, supported by BC Next Level initiatives.

Volume growth was positive in most Global Chocolate regions.

The largest contributor to Global Chocolate volume growth was Western Europe (+2.2%), as the business captured the consumer shift to Private Label products and Gourmet saw solid demand.

Central and Eastern Europe (+3.5%) also saw a robust performance, led by a recovery in Food Manufacturers volume in Türkiye and South East Europe as well as strong momentum for Gourmet.

Volume growth in Latin America accelerated in the second quarter, leading to +6.2% in the first half, led by Gourmet in Brazil.

Sales volume in North America declined (-1.9%), as weaker consumer sentiment impacted Food Manufacturers in the region, while Gourmet saw solid demand.

Region Asia Pacific, Middle East and Africa also saw a decline (-0.6%) in the context of a challenging consumer and inflationary environment, particularly in Greater China and Indonesia. Outside of these markets, volume growth in the region was high single-digit.

Sales volume for Global Cocoa declined -0.7%, in the context of significant cocoa price increases. The business continued to source well in a difficult environment. Overall, large Food Manufacturers saw volume pressure, partly offset by positive growth for regional customers particularly in Asia. The sales decrease was primarily due to reduced demand for cocoa butter and liquor. Cocoa butter demand was impacted in Asia, Latin America and North America, while other regions saw positive growth. For cocoa liquor, positive growth for Eastern Europe, Middle East Africa and Latin America was offset by lower demand in Asia, Western Europe and North America. Demand for cocoa powder remained robust, largely driven by Asia with particular strength in India, Indonesia and China.

Sales revenue amounted to CHF 4,643.0 million, up +19.6% in local currencies (+11.1% in CHF). Growth was driven by the significant increase in cocoa prices as well as the broader inflationary environment, which Barry Callebaut manages through its cost-plus pricing model for the majority of its business.

Gross profit amounted to CHF 663.1 million, up +8.6% in local currencies (-0.2% in CHF), supported by mix as well as the inflationary environment being well managed through the company's cost-plus pricing model.

Operating profit (EBIT) recurring5 was solid and amounted to CHF 339.4 million, an increase of +7.9% in local currencies (-2.6% in CHF) compared to the prior year. The increase was well ahead of volume growth, reflecting the pass-through of higher financing costs which are offset below the EBIT level, as well as mix. Recurring5 EBIT for Global Chocolate was CHF 348.1 million, up +11.4% in local currencies (-0.6% in CHF). Recurring5 EBIT for Global Cocoa was CHF 45.9 million, down -5.3% in local currencies (-11.7% in CHF). The decline was driven by the continuous increase in bean differentials in West African countries and other primary origins, as well as increased terminal market prices, which negatively impacted pressed product margins. Recurring5 EBIT per tonne amounted to CHF 298, up +7.2% in local currencies (-3.3% in CHF).

EBIT reported was CHF 178.1 million, including one-off BC Next Level operating expenses. In total, CHF 91.5 million of the one-off items were non-cash impairments and write-downs related to the planned site closures.

Net profit for the period recurring5 was up +0.8% in local currencies (-7.9% in CHF), growing in line with volumes. This demonstrates the company's ability to protect margins through its cost-plus model in the highly inflationary environment. Higher net financing costs were compensated through the cost-plus model at the gross profit and EBIT level. Net profit reported was CHF 76.8 million, including one-off BC Next Level operating expenses.

Net working capital increased to CHF 2,775.7 million from CHF 1,699.3 million in the prior-year period, almost entirely due to the negative impact from significantly higher bean prices, given the long cycle between bean contracting and customer sales.

Free cash flow generation amounted to CHF -1,116.3 million, compared to CHF -188.2 million in prior-year period. The decrease reflects the CHF 1,076 million step up in working capital as a result of significantly higher bean prices as well as higher BC Next Level investments, which more than offset operational working capital improvements.

Net debt increased to CHF 2,637.4 million compared to CHF 1,581.5 million in the prior-year period, as a consequence of the higher working capital. Adjusted Net debt6 decreased to CHF 245.7 million, compared to CHF 368.4 million in the prior-year period, taking into consideration the cocoa bean inventories as readily marketable inventories (RMI), helped by operational working capital improvements.

5 Please refer to appendix on page 8 for the detailed recurring results reconciliation.

6 Net debt adjusted for cocoa bean inventories regarded by the Group as readily marketable inventories (February 2024: CHF2,391.7 million; February 2023: CHF 1,213.1 million).

BC Next Level update

To unlock its full potential for the future, Barry Callebaut launched its strategic investment program, BC Next Level, in September 2023. As part of the program, the company will move closer to customers and markets and simplify and digitalize the front and back ends of its business. This plan ultimately positions the Group for sustainable profitable growth and allows for a more attractive financial profile by elevating profitability and improving cash flow.

The implementation of the program is progressing as planned. More than 25 country clusters have been established, with all regional presidents and country general managers appointed and making solid progress in building commercial momentum globally. The company is building a centralized global end to end supply chain, with a dedicated customer innovation organization already launched. Barry Callebaut is also centralizing all enabling functions to step change standardization and digitalization. Significant progress has been made to simplify the portfolio, with around 10% of SKUs already phased out and the remaining reductions identified and scheduled to be discontinued to reach the at least 30% planned total reduction. The optimization of the Group's manufacturing network and the implementation of GBS (Global Business Services) are well prepared. As a result of moving to a more effective operating model, optimizing the manufacturing footprint and creating a step change in digitalization, the Group expects to reduce costs by approximately 15%, excluding raw materials. Discussions with social partners are ongoing.

Refinancing measures

The significant increase in cocoa prices over recent months has created an industry wide impact on working capital requirements. Thanks to the strength of its balance sheet, Barry Callebaut has already addressed this development with a successful Swiss franc bond issuance of CHF 600 million to refinance the existing EUR 450 million senior bond falling due mid May 2024 and the extension of the Group's Revolving Credit Facility amount from EUR 900 million to EUR 1,312.5 million. The Group has also implemented a Syndicated Term Loan for an amount of EUR 262.5 million and a tenor of 2 years.

Guidance

The company expects a highly volatile environment and is cautiously navigating through uncertainty. In that context, Barry Callebaut reiterates Full-Year 2023/24 guidance of flat volume and flat EBIT on a recurring basis in constant currency, including modest BC Next Level benefits.

Price developments of key raw materials

During the first six months of fiscal year 2023/24, terminal market7 prices for cocoa beans fluctuated between GBP 2,904 and GBP 5,558 per tonne, closing the period at GBP 5,162 per tonne on February 29, 2024. On average, cocoa bean prices increased by +81% versus the prior-year period and closed the period +75% higher. The consensus view of cocoa bean supply and demand maintains a deficit for 2023/24.

The world market price of sugar decreased by -13% given the unexpected extension of the sugar campaign in Centre-South Brazil which resulted in a rebalancing of the world market deficit. Sugar prices in Europe decreased by -28% during the period under review, mainly due to sugar beet acreage gains in the 2023/24 campaign, the strong pace of Ukrainian exports into the EU, and lower energy prices.

Dairy prices increased by +13% during the first six months of fiscal year 2023/24. Milk supply decreased year-on-year across the globe as low milk payments, declining herd sizes, disease (Blue Tongue Virus in Europe) and environmental constraints placed considerable strain on dairy farmers.

7 Source: London terminal market prices for 2nd position, September 2023 to February 2024. Terminal market prices exclude Living Income Differential (LID) and country differentials.

More detailed financial information can be found in the “Half-Year Results 2023/24 Report”.

Media and Analyst Conference of the Barry Callebaut Group

| Date: | Wednesday, April 10, 2024, at 10:00 – 11:30 CEST |

| Location: | SIX Convention Point, Pfingstweidstrasse 110, 8005 Zurich |

This will be a physical conference hosted by Peter Feld, CEO, and Peter Vanneste, CFO, which can also be followed via telephone or webcast. Dial-in and access details can be found here.

Financial Calendar for Fiscal Year 2023/24:

(September 1, 2023, to August 31, 2024)

| 9-Month Key Sales Figures 2023/24 | July 11, 2024 |

| Full-Year Results 2023/24 | November 6, 2024 |

| Annual General Meeting 2023/24 | December 4, 2024 |

Downloads

-

Press Release English

-

Press Release German

-

Half-Year Report

-

Analyst and Media Presentation

8 Financial performance measures, not defined by IFRS, are defined in the Annual Report 2022/23 on page 188.

9 Please refer to appendix for the detailed recurring results reconciliation.

10 Adjusted Free cash flow is adjusted for the cash flow impact of cocoa bean inventories regarded by the Group as readily marketable inventories (RMI).

Appendix: Recurring results reconciliation

The reconciliation of non-recurring items of the first six months of the fiscal year 2023/24 and their impact on the Group's Key APMs can be found in the table below. There were no non-recurring items in the comparative six-month period of the fiscal year 2022/23.

11 Prior-year figures are restated, please refer to Note 1 of the Consolidated Interim Financial statements of the Half-Year Report 2023/24 for details.

12 Reported as "Other income", excluding interest income of CHF 5.3 million which is reported as "Finance income".

13 Thereof CHF 3.3 million write-down of inventories reported as "Cost of goods sold", CHF 24.0 million BC Next Level program cost reported as "General and administration expenses" and CHF 141.8 million BC Next Level cost reported as "Other expense". Please refer to Note 3 of the Consolidated Interim Financial statements of the Half-Year Report 2023/24 for details.

About Barry Callebaut Group:

With annual sales of about CHF 8.5 billion in fiscal year 2022/23, the Zurich-based Barry Callebaut Group is the world’s leading manufacturer of chocolate and cocoa products – from sourcing and processing cocoa beans to producing the finest chocolates, including chocolate fillings, decorations and compounds. The Group runs 66 production facilities worldwide and employs a diverse and dedicated global workforce of more than 13,000 people. The Barry Callebaut Group serves the entire food industry, from industrial food manufacturers to artisanal and professional users of chocolate, such as chocolatiers, pastry chefs, bakers, hotels, restaurants or caterers. The global brands catering to the specific needs of these Gourmet customers are Callebaut® and Cacao Barry®, Carma® and the decorations specialist Mona Lisa®. The Barry Callebaut Group is committed to make sustainable chocolate the norm to help ensure future supplies of cocoa and improve farmer livelihoods. It supports the Cocoa Horizons Foundation in its goal to shape a sustainable cocoa and chocolate future.

Contact for the media:

Kai Hummel

Global of Head of Communications

Barry Callebaut AG

+41 43 204 15 22

[email protected]

for investors and financial analysts:

Sophie Lang

Head of Investor Relations

Barry Callebaut AG

+41 79 275 83 95

[email protected]