Compensation, shareholdings and loans

Compensation, shareholdings and loans

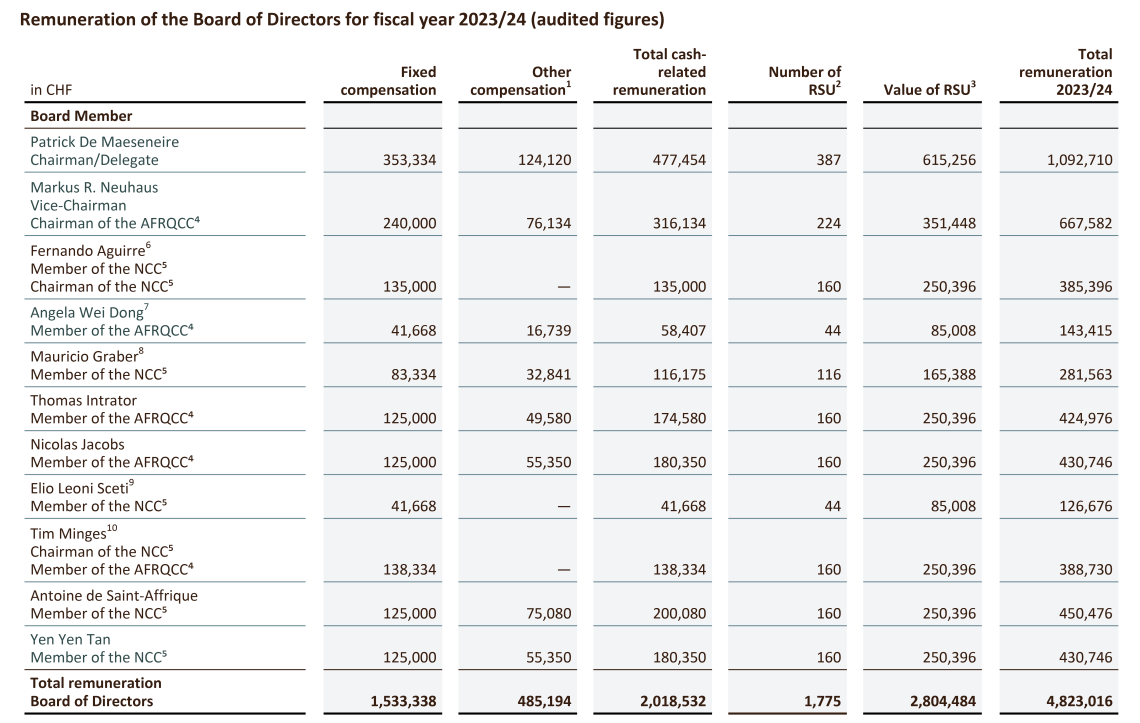

The remuneration structure of the Board of Directors is annually reviewed and determined at the discretion of the Board of Directors. It consists of fixed fees and grants of Barry Callebaut AG share awards. In order to reinforce the independence of the Board in exercising its supervisory duties towards executive management, its remuneration is not linked to any performance criteria. Board members do not receive any lump-sum payments for expenses. The remuneration of the members of the Board is subject to the mandatory social security contributions.

Remuneration of the Board of Directors for fiscal year 2023/24 (audited figures)

1 Including social security contributions.

2 Number of shares granted in relation to the fiscal year under review; Grants to the BoD are based on the service period between Annual General Meetings of Shareholders.

3 Value defined as grant value at the beginning of the term of office.

4 Audit, Finance, Risk, Quality & Compliance Committee.

5 Nomination & Compensation Committee.

6 Member of the NCC until December 6, 2023; Chairman of the NCC as of December 6, 2023.

7 Member of the Board and member of the AFRQCC until December 6, 2023.

8 Member of the Board and member of the NCC as of December 6, 2023.

9 Member of the Board and member of the NCC until December 6, 2023.

10 Chairman of the NCC and member of the AFRQCC until December 6, 2023; member of the Board and member of the AFRQCC as of December 6, 2023.

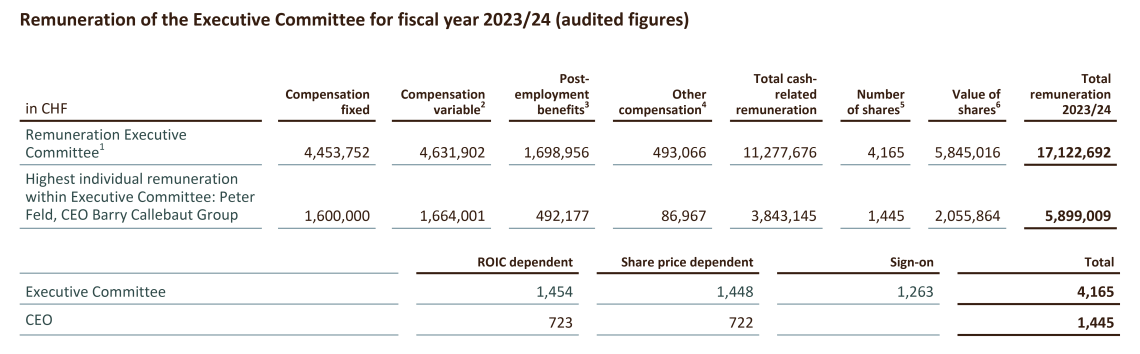

Remuneration of the Executive Committee

The individual remuneration of the members of the Executive Committee is reviewed annually and determined at the discretion of the Board of Directors, based on the proposal of the NCC, in accordance with the principles set out in the Executive Total Reward Policy, market information and data, scope and level of responsibility of the position, and profile of the incumbents in terms of qualification, experience and skills set.

The remuneration structure for the Executive Committee of Barry Callebaut consists of four main remuneration elements: a fixed annual base salary, an annual short-term cash bonus pursuant to the Company’s Short-Term Incentive Plan, share-based long-term incentives pursuant to the Company’s Long-Term Incentive Plan and other benefits.

| Base salary (fixed) | Annual gross base salary |

|

| Annual cash bonus (variable) | Barry Callebaut Short-Term Incentive Plan (STIP) |

|

| Share based awards (variable) | Barry Callebaut Long-Term Incentive Plan (LTIP) |

|

| Other benefits | Risk benefits and perquisites |

|

Remuneration of the Executive Committee for fiscal year 2023/24 (audited figures)

1 Disclosure relates to the Executive Committee including all members during fiscal year 2023/24, i.e.: Ben De Schryver until 1 November 2023, Peter Feld, Steven Retzlaff, Massimo Selmo, Jutta Suchanek as of 1 October 2023, Jo Thys until 30 September 2023, Peter Vanneste as of 1 November 2023 and Clemens Woehrle as of 1 October 2023.

2 Based on best estimate of expected payout for fiscal year 2023/24 (accrual principle).

3 Including social security and pension contributions.

4 Includes international relocation costs, assignment related benefits such as tax equalization, schooling costs as well as international insurance coverage.

5 Number of shares granted in relation to the fiscal year 2023/24 as follows: CFO: Sign-on bonus amounting to 736 shares, delivered as restricted share units and vesting as follows: 442 shares vesting on 1 November 2024, 147 shares vesting at 1 November 2025, 147 shares vesting at 1 November 2026. The shares will forfeit if the incumbent terminates the employment prior to the vesting dates. CSDO: Sign-on Bonus amounting to 527 restricted shares, blocked for 3 years. LTIP CEO: 723 ROIC-dependent performance share units and 722 share price dependent performance share units; LTIP for all other members of the Executive Committee: 731 ROIC-dependent performance share units and 726 share price-dependent performance share units.

6 The value of the restricted shares is defined as fair value at grant date (CHF 1,424). The value of the restricted share units is defined as fair value at grant date (CHF 1,314). The value of the ROIC-dependent PSU is the market price at grant date (CHF 1,485) discounted for dividends until the vesting. For share price-dependent PSU, the fair value is established based on a valuation performed by external experts applying the “Monte Carlo simulation” method (CHF 1,360) excluding the net present value of expected dividends.