3-Month Key Sales Figures

Fiscal Year 2019/20

3-Month Key Sales Figures

Fiscal Year 2019/20

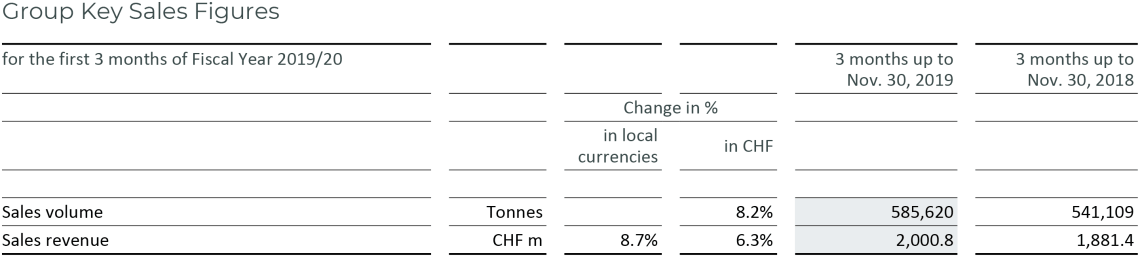

- Sales volume up +8.2%

- Sales revenue of CHF 2,000.8 million, up +8.7% in local currencies

- On track to deliver on mid-term guidance1

We had a strong start to the year, outperforming the overall flat underlying chocolate confectionery market. Our volume growth was broad based, with positive contributions from all Regions and key growth drivers.

The Barry Callebaut Group, the world’s leading manufacturer of high-quality chocolate and cocoa products, increased its sales volume by +8.2% to 585,620 tonnes during the first three months of fiscal year 2019/20 (ended on November 30, 2019). Sales volume in the chocolate business grew by +7.7%, well above the global chocolate confectionery market which was flat (-0.0%)2. Growth was supported by all Regions and key growth drivers: Outsourcing (+2.7%), Emerging Markets (+16.7%) and Gourmet & Specialties (excluding Beverage, +4.4%). Sales volume in Global Cocoa grew +10.2%.

Excluding the first-time contribution from the consolidation of Inforum, organic volume growth was +6.2%. Sales revenue amounted to CHF 2,000.8 million, which represents an increase of +8.7% in local currencies (+6.3% in CHF).

Looking ahead, CEO Antoine de Saint-Affrique said:

The strong start to the year, together with a healthy portfolio and the diligent execution of our ‘smart growth’ strategy, give us confidence that we are on track to deliver on our mid-term guidance for the period ending with fiscal year 2021/22.

1 On average for the 3-year period 2019/20 to 2021/22: +4-6% volume growth and EBIT above volume growth in local currencies, barring any major unforeseeable events.

2 Source: Nielsen, volume growth excluding e-commerce – 25 countries, September to November 2019, data subject to adjustment to match Barry Callebaut’s reporting period.

Strategic milestones in the first three months of fiscal year 2019/20

Innovation: In September 2019, Barry Callebaut introduced ‘Cacaofruit Experience’, a new Food & Drink category including Wholefruit chocolate. Whereas normally 70% of the cacaofruit is discarded as waste, ‘Cacaofruit Experience’ makes use of the entire fruit. This results in highquality ingredients for applications such as juices, smoothies, frozen desserts, bakery and pastry products, all the way to chocolate. First ‘Cacaofruit Experience’ products for consumers are already being piloted in California, United States.

In November 2019, Barry Callebaut was granted a Temporary Marketing Permit (TMP) by the US Food and Drug Administration (FDA), clearing the way to market Ruby as chocolate in the United States. This is an important regulatory milestone towards establishing Ruby chocolate as the fourth type of chocolate. Only two years ago the first consumer brand launched Ruby chocolate and more than 70 brands in more than 50 countries have followed worldwide since.

The Barry Callebaut Gourmet brand Mona Lisa launched Ruby chocolate decorations, a convenient way for chefs to add a spark to any creation with the unique Ruby taste and color. Furthermore, in January 2020 Costa Coffee, the UK’s leading coffee shop, launched Ruby hot chocolate. Also in January 2020, Unilever launched Magnum Ruby ice cream bars in the United States, Germany and the UK.

Cost Leadership: In the first three months of fiscal year 2019/20 three additional Barry Callebaut factories were integrated into the Group’s global SAP system. The ongoing roll-out of a global SAP system will enhance the Group’s cost competitiveness through more efficient business processes as well as digital solutions. As part of the Group’s ongoing efforts to optimize its cost structure and in the light of the declining Indonesian cocoa crop, Barry Callebaut has announced the closure of its cocoa factory in Makassar, Indonesia, in January 2020. The Group’s growth in Region Asia Pacific will be well supported by its other factories in the region.

Sustainability: Barry Callebaut published its third Forever Chocolate progress report on December 4, 2019, highlighting the progress of the Group towards making sustainable chocolate the norm by 2025. The achievements include that the Group sustainably sourced 47% of its cocoa and 54% of its other ingredients in fiscal year 2018/19. Furthermore, Barry Callebaut reduced its corporate CO2 equivalent (CO2e) footprint from 9.10 million tonnes to 8.49 million tonnes (-6.7%), while achieving a +5.1% increase in sales volume in fiscal year 2018/19. In addition, Barry Callebaut distributed over 1.8 million young cocoa seedlings and almost 750,000 shade trees for replanting in Côte d’Ivoire and Ghana. The Group also announced that as of end 2018/19 it had full data on 176,984 farms entered into its Katchilè database. This database provides key insights into the location, farm size, socio-economic and household data of cocoa farms and their farmers.

Regional/Segment performance

Region EMEA – Strong growth continued

Sales volume of Barry Callebaut in Region EMEA (Europe, Middle East and Africa) increased by +8.7% to 269,636 tonnes. Excluding the first-time consolidation of Inforum as of February 2019, organic growth was +4.0%, again outpacing the underlying chocolate confectionery market (+0.3%)3. Food Manufacturers continued its solid growth in Western Europe and posted doubledigit volume growth in Eastern Europe. Gourmet continued its steady growth in the first three months of the fiscal year. Gourmet & Specialties’ overall volume growth was, as expected, impacted by negative Beverage volume. Actions to address the negative Beverage volume have been implemented and are expected to deliver results in the second half of the fiscal year. Sales revenue increased by +8.5% in local currencies (+5.2% in CHF) to CHF 845.6 million.

Region Americas – Solid start

Against a strong prior-year comparator, Region Americas increased its sales volume by +3.3% to 152,843 tonnes, well ahead of the declining regional chocolate confectionery market (-3.0%)3. Volume growth was supported by both Food Manufacturers and Gourmet. In South America, Gourmet continued its double-digit growth. Sales revenue increased by +4.2% in local currencies (+4.1% in CHF) to CHF 499.4 million.

Region Asia Pacific – Strong momentum continues

Volume growth in Region Asia Pacific continued the strong growth momentum with +21.8% to 33,486 tonnes. Volume growth again significantly outpaced the regional chocolate confectionery market (+6.3%)3. Growth was fueled by Food Manufacturers – mainly with regional accounts – as well as double-digit growth in Gourmet & Specialties in key markets such as China and India. Sales revenue increased by +12.8% in local currencies (+14.1% in CHF) to CHF 112.3 million.

Global Cocoa – Exceptional growth against weak comparator

Global Cocoa delivered exceptional growth against a weak prior-year comparator. Sales volume increased by +10.2% to 129,655 tonnes. Sales revenue increased by +12.5% in local currencies (+8.8% in CHF) to CHF 543.5 million, reflecting the higher cocoa bean prices.

Price developments of the most important raw materials

During the first three months of 2019/20 cocoa bean prices fluctuated between GBP 1,757 and GBP 1,944 per tonne and closed at GBP 1,881 per tonne on November 30, 2019. On average, cocoa bean prices increased by +14.8% versus the prior-year quarter. Global bean supply and demand remained balanced. Côte d’Ivoire and Ghana announced in July 2019 a living income differential (LID) of USD 400 per tonne of cocoa beans, effective as of the 2020/21 crop.

Sugar prices in Europe on average increased +31.6% compared to the prior-year first quarter, due to uncertainty about the crop outlook. World sugar prices on average decreased by -4.1%. Dairy prices on average increased by +48.0% compared to the same prior-year quarter on the back of weaker milk production combined with continued good demand.

3 Source: Nielsen, volume growth excluding e-commerce – September to November 2019, data subject to adjustment to match Barry Callebaut’s reporting period.

Financial Calendar for Fiscal Year 2019/20

(September 1, 2019 to August 31, 2020)

| Half-Year Results 2019/20 | April 16, 2020 |

| 9-Month Key Sales Figures 2019/20 | July 9, 2020 |

| Full-Year Results 2019/20 | November 11, 2020 |

| Annual General Meeting 2019/20 | December 9, 2020 |

Barry Callebaut Group key sales figures

Available downloads

About Barry Callebaut Group

With annual sales of about CHF 7.3 billion (EUR 6.5 billion / USD 7.4 billion) in fiscal year 2018/19, the Zurich based Barry Callebaut Group is the world’s leading manufacturer of high-quality chocolate and cocoa products – from sourcing and processing cocoa beans to producing the finest chocolates, including chocolate fillings, decorations and compounds. The Group runs more than 60 production facilities worldwide and employs a diverse and dedicated global workforce of more than 12,000 people.

The Barry Callebaut Group serves the entire food industry, from industrial food manufacturers to artisanal and professional users of chocolate, such as chocolatiers, pastry chefs, bakers, hotels, restaurants or caterers. The two global brands catering to the specific needs of these Gourmet customers are Callebaut® and Cacao Barry®.

The Barry Callebaut Group is committed to make sustainable chocolate the norm by 2025 to help ensure future supplies of cocoa and improve farmer livelihoods. It supports the Cocoa Horizons Foundation in its goal to shape a sustainable cocoa and chocolate future.